Latest JDPower Indicates Tundra Off to a Strong Start ? . . .

#1

Initial trading patterns for the all-new 2007 Toyota Tundra suggest a strong start for this model in the domestic-dominated large pickup segment, according to real-time retail transaction data from the Power Information Network (PIN), a division of J.D. Power and Associates.

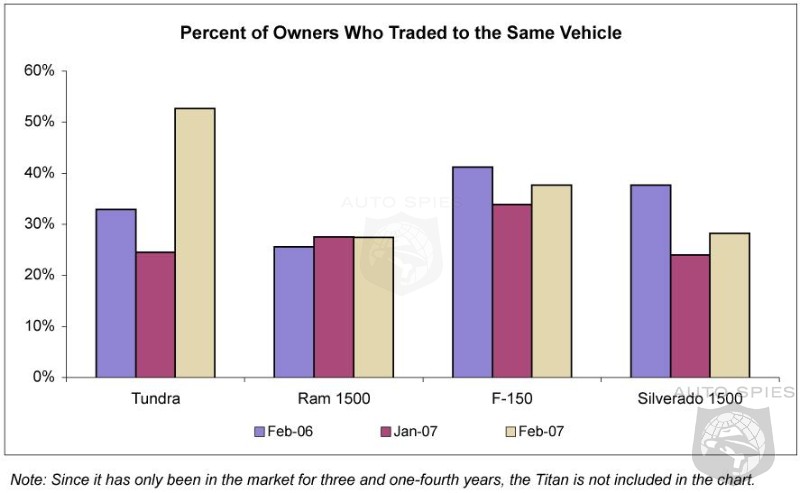

Since the all-new 2007 Toyota Tundra large pickup was launched in early February, owner loyalty for this model, which represents the percentage of Tundra owners who traded for another Tundra, is 53 percent (February only)—more than twice the January rate of its predecessor and more than 20 percentage points higher than in February of 2006. Additionally, trading from the Tundra to each of the mainstream domestic large pickups (Chevrolet Silverado 1500, Ford F-150, Ram 1500) dropped considerably in February when compared with January, while trading in the reverse direction increased.

Nevertheless, owners of domestic large pickups remained relatively loyal to their vehicles. According to PIN data, both the Silverado 1500 and F-150 experienced owner loyalty increases of 4 percentage points when comparing transactions in February to those in January, while the Ram’s owner loyalty remained steady. (Loyalty for the Titan is not included since it has only been on the market for three and one-fourth years.)

The combination of increased Tundra loyalty and steady domestic model loyalty raised the large pickup segment share of industry from 12.4 percent in January to 14.4 percent in February.

“It’s still early, and owner loyalty is just one measure of marketplace success, but so far the Tundra seems to be gaining strength in the segment,” said Tom Libby, senior director of industry analysis at PIN. “This is an interesting scenario because the impressive strength of the Toyota juggernaut is being pitted against the domestics’ long-time stronghold.”

The Tundra’s owner loyalty rose in February even though it sold at a higher average retail transaction price than any of its direct competitors. The actual retail transaction price for the all-new 2007 Tundra in February was $33,182—almost $900 more than the F-150 ($32,312) and $1,450 more than the Silverado 1500 ($31,727). The Ram 1500 ($25,564) and the Titan ($27,664) both sold at prices considerably below the competition.

Four of five large pickup models sold with loans that included an annual percentage rate (APR) between 9 and 11 percent, while the F-150’s APR was far below the competition at slightly more than 7 percent. The monthly payment for these models, purchased with a 72-month loan, ranged from $558 to $603.

“New products and stable fuel prices will drive a strong rebound in the large pickup segment in 2007, increasing from 13.5 percent of the total sales market in 2006 to 14.2 percent,” said Jeff Schuster, executive director of automotive intelligence at J.D. Power and Associates. “Toyota dove head first into a very competitive segment with a solid entry, and although the model lineup is not yet as robust as the competition, we expect the Tundra to nearly double in volume from 124,508 in 2006 to 210,000 in 2007.”

PIN data also indicates that while the national transaction price for the 2007 Tundra was the highest in the competitive set, the Tundra did not sell at the highest price in every region of the country. Specifically, the Tundra commanded the highest transaction price in the Midwest, Southwest and West, but its price was second highest in the Northeast (after the F-150) and third in the Southeast (after the Silverado 1500 and F-150). Additionally, the Tundra’s price ranged from a high of $34,394 in the West to a low of $32,796 in the Southwest. Transaction prices in the Southwest for each of the five large pickup models were lower than in any other region, reflecting the fierce competition in large pickups in this particular part of the country.

Since the all-new 2007 Toyota Tundra large pickup was launched in early February, owner loyalty for this model, which represents the percentage of Tundra owners who traded for another Tundra, is 53 percent (February only)—more than twice the January rate of its predecessor and more than 20 percentage points higher than in February of 2006. Additionally, trading from the Tundra to each of the mainstream domestic large pickups (Chevrolet Silverado 1500, Ford F-150, Ram 1500) dropped considerably in February when compared with January, while trading in the reverse direction increased.

Nevertheless, owners of domestic large pickups remained relatively loyal to their vehicles. According to PIN data, both the Silverado 1500 and F-150 experienced owner loyalty increases of 4 percentage points when comparing transactions in February to those in January, while the Ram’s owner loyalty remained steady. (Loyalty for the Titan is not included since it has only been on the market for three and one-fourth years.)

The combination of increased Tundra loyalty and steady domestic model loyalty raised the large pickup segment share of industry from 12.4 percent in January to 14.4 percent in February.

“It’s still early, and owner loyalty is just one measure of marketplace success, but so far the Tundra seems to be gaining strength in the segment,” said Tom Libby, senior director of industry analysis at PIN. “This is an interesting scenario because the impressive strength of the Toyota juggernaut is being pitted against the domestics’ long-time stronghold.”

The Tundra’s owner loyalty rose in February even though it sold at a higher average retail transaction price than any of its direct competitors. The actual retail transaction price for the all-new 2007 Tundra in February was $33,182—almost $900 more than the F-150 ($32,312) and $1,450 more than the Silverado 1500 ($31,727). The Ram 1500 ($25,564) and the Titan ($27,664) both sold at prices considerably below the competition.

Four of five large pickup models sold with loans that included an annual percentage rate (APR) between 9 and 11 percent, while the F-150’s APR was far below the competition at slightly more than 7 percent. The monthly payment for these models, purchased with a 72-month loan, ranged from $558 to $603.

“New products and stable fuel prices will drive a strong rebound in the large pickup segment in 2007, increasing from 13.5 percent of the total sales market in 2006 to 14.2 percent,” said Jeff Schuster, executive director of automotive intelligence at J.D. Power and Associates. “Toyota dove head first into a very competitive segment with a solid entry, and although the model lineup is not yet as robust as the competition, we expect the Tundra to nearly double in volume from 124,508 in 2006 to 210,000 in 2007.”

PIN data also indicates that while the national transaction price for the 2007 Tundra was the highest in the competitive set, the Tundra did not sell at the highest price in every region of the country. Specifically, the Tundra commanded the highest transaction price in the Midwest, Southwest and West, but its price was second highest in the Northeast (after the F-150) and third in the Southeast (after the Silverado 1500 and F-150). Additionally, the Tundra’s price ranged from a high of $34,394 in the West to a low of $32,796 in the Southwest. Transaction prices in the Southwest for each of the five large pickup models were lower than in any other region, reflecting the fierce competition in large pickups in this particular part of the country.

#2

U.S. truck makers keeping tabs on Tundra

Domestics lead truck segment in crash safety, but Toyota is building demand in market.

Christine Tierney / The Detroit News

In a market as competitive as the full-size pickup segment, every distinction counts. So Detroit's automakers heaved a sigh of relief when Toyota Motor Corp.'s much-touted new Tundra earned lower frontal crash test scores than domestic rivals such as the Ford F-150 and Dodge Ram.

Toyota, however, can take comfort from early data showing that consumers are paying more for the Tundra, on average, than for leading rivals.

All automakers stand to benefit from indications that the high-stakes contest in the pickup segment is stimulating demand.

The lucrative full-size pickup segment expanded to 14.4 percent of the U.S. auto market last month, when Toyota launched the Tundra, from 12.4 percent in January, according to consulting firm J.D. Power and Associates.

Its Power Information Network division said domestic truck owners remained loyal to U.S. brands, but Toyota retained more of its existing customers by fielding a pickup with capabilities and performance similar to those of the domestic-brand trucks.

"It's still early, and owner loyalty is just one measure of marketplace success, but so far the Tundra seems to be gaining strength in the segment," said Tom Libby, director of industry analysis at the Power Information Network.

But the crash test data from the U.S. National Highway Traffic Safety Administration underscored the domestics' ability to roll out solid products in the pickup category.

By contrast with their performance in the passenger car market, where they were pushed back by Japanese brands, U.S. automakers have held their own in the truck market. American brands account for more than 90 percent of full-size pickup sales, which totaled 2.2 million units in 2006.

"This is an interesting scenario because the impressive strength of the Toyota juggernaut is being pitted against the domestics' longtime stronghold," Libby said.

In U.S. government frontal crash tests, the Tundra earned four stars for the driver and passenger. While that is a respectable score, it's below the five stars awarded to the Ford F-150, the Dodge Ram and some Chevrolet Silverado models.

In a frontal collision at 35 miles per hour, the driver and front-seat passenger of a vehicle with a five-star rating are judged to have a 10 percent or lower chance of requiring immediate hospitalization. That probability increases to between 11 percent and 20 percent for a four-star-rated vehicle.

Hauling in the most cash

Another indicator closely watched by manufacturers and financial analysts shows the Tundra commanded the highest selling prices among the leading pickups in most regions of the country since its launch in February.

The actual retail transaction prices -- or what an individual customer pays at a dealership -- for a four-door Tundra with an eight-cylinder engine averaged $33,182. That compares with $32,312 for a similar F-150, $31,727 for a Chevy Silverado, $27,664 for a Nissan Titan, and $25,564 for a Dodge Ram 1500, according to Power Information Network.

Toyota is expected to surpass its goal to sell 200,000 new Tundras this year, compared with 124,508 previous-generation Tundras in 2006, said Jeff Schuster, J.D. Power's executive director of automotive intelligence.

With the new truck, Toyota hopes to keep owners of Toyota vehicles such as the smaller Tacoma pickup from straying to other brands when they seek a full-size pickup.

Toyota builds the Tundra at plants in Princeton, Ind., and San Antonio, Texas.

Christine Tierney / The Detroit News

In a market as competitive as the full-size pickup segment, every distinction counts. So Detroit's automakers heaved a sigh of relief when Toyota Motor Corp.'s much-touted new Tundra earned lower frontal crash test scores than domestic rivals such as the Ford F-150 and Dodge Ram.

Toyota, however, can take comfort from early data showing that consumers are paying more for the Tundra, on average, than for leading rivals.

All automakers stand to benefit from indications that the high-stakes contest in the pickup segment is stimulating demand.

The lucrative full-size pickup segment expanded to 14.4 percent of the U.S. auto market last month, when Toyota launched the Tundra, from 12.4 percent in January, according to consulting firm J.D. Power and Associates.

Its Power Information Network division said domestic truck owners remained loyal to U.S. brands, but Toyota retained more of its existing customers by fielding a pickup with capabilities and performance similar to those of the domestic-brand trucks.

"It's still early, and owner loyalty is just one measure of marketplace success, but so far the Tundra seems to be gaining strength in the segment," said Tom Libby, director of industry analysis at the Power Information Network.

But the crash test data from the U.S. National Highway Traffic Safety Administration underscored the domestics' ability to roll out solid products in the pickup category.

By contrast with their performance in the passenger car market, where they were pushed back by Japanese brands, U.S. automakers have held their own in the truck market. American brands account for more than 90 percent of full-size pickup sales, which totaled 2.2 million units in 2006.

"This is an interesting scenario because the impressive strength of the Toyota juggernaut is being pitted against the domestics' longtime stronghold," Libby said.

In U.S. government frontal crash tests, the Tundra earned four stars for the driver and passenger. While that is a respectable score, it's below the five stars awarded to the Ford F-150, the Dodge Ram and some Chevrolet Silverado models.

In a frontal collision at 35 miles per hour, the driver and front-seat passenger of a vehicle with a five-star rating are judged to have a 10 percent or lower chance of requiring immediate hospitalization. That probability increases to between 11 percent and 20 percent for a four-star-rated vehicle.

Hauling in the most cash

Another indicator closely watched by manufacturers and financial analysts shows the Tundra commanded the highest selling prices among the leading pickups in most regions of the country since its launch in February.

The actual retail transaction prices -- or what an individual customer pays at a dealership -- for a four-door Tundra with an eight-cylinder engine averaged $33,182. That compares with $32,312 for a similar F-150, $31,727 for a Chevy Silverado, $27,664 for a Nissan Titan, and $25,564 for a Dodge Ram 1500, according to Power Information Network.

Toyota is expected to surpass its goal to sell 200,000 new Tundras this year, compared with 124,508 previous-generation Tundras in 2006, said Jeff Schuster, J.D. Power's executive director of automotive intelligence.

With the new truck, Toyota hopes to keep owners of Toyota vehicles such as the smaller Tacoma pickup from straying to other brands when they seek a full-size pickup.

Toyota builds the Tundra at plants in Princeton, Ind., and San Antonio, Texas.

#3

That chart only tells us that a decent number of existing owners traded in their old Tundra for a new one. Which is kind of what one would expect with the release of a new model.

I love how JD Toyota continually finds new ways to assemble and present seemingly useless data, and keep themselves in business.

I love how JD Toyota continually finds new ways to assemble and present seemingly useless data, and keep themselves in business.

#4

That chart only tells us that a decent number of existing owners traded in their old Tundra for a new one. Which is kind of what one would expect with the release of a new model.

I love how JD Toyota continually finds new ways to assemble and present seemingly useless data, and keep themselves in business.

I love how JD Toyota continually finds new ways to assemble and present seemingly useless data, and keep themselves in business.

Originally Posted by JD Power

Since the all-new 2007 Toyota Tundra large pickup was launched in early February, owner loyalty for this model, which represents the percentage of Tundra owners who traded for another Tundra, is 53 percent (February only)—more than twice the January rate of its predecessor and more than 20 percentage points higher than in February of 2006. Additionally, trading from the Tundra to each of the mainstream domestic large pickups (Chevrolet Silverado 1500, Ford F-150, Ram 1500) d

ropped considerably in February when compared with January, while trading in the reverse direction increased.

ropped considerably in February when compared with January, while trading in the reverse direction increased.

The other bit of info I outlined in bold is that the new Tundra is getting more domestic conquest buyers than ever before. Buried in some Toyota article or press release, Toyota says that about 25 - 30% of February Tundra sales were from domestic buyers trading in their trucks.

So the new Tundra is retaining a lot of current Toyota truck buyers and owners, while attracting a large number of domestic truck buyers.

#5

#6

I like Toyota just fine. I know that I don't care for JD Power, though, which sure seems to be privately "funded" by Toyota/Lexus. The never-ending flow of basically useless data that puts Toyota on a ridiculously high pedestal really makes you wonder sometimes.

But back on topic, please.

But back on topic, please.

Trending Topics

#8

That's your opinion that you think it's useless information but for other people it shows that many people are loyal to Toyota. I for one have never owned an American car so I never experienced car troubles like many people who have owned Amercian cars because of reading reports like this. I have been well informed. Toyota has built a reputation for being dependable, reliable, etc. that why JD Power puts them on a pedestal.

#9

If I was in the market for a new family car, and decided to buy an Accord because I'm rather partial to Hondas, and decided to not even look at the Camry, does that make the Accord a better car? Nope.

#10

Interesting stats for sure. Most anything new that is nice shows similar results. I do not expect the new Tundra to ,"take over" the domestic market but it will put a dent in it for sure. Most anything new nowadays from makers are pretty nice cept for my Fusion.

#11

That kind of helped prove my point. If a person is loyal to Toyota, they're probably more likely to buy the new Tundra without giving the other brands much thought... whether the Tundra is a better truck than the others, or not. That being the case, it's useless information when trying to determine which truck is the best fit for me, you, are the guy down the block.

If I was in the market for a new family car, and decided to buy an Accord because I'm rather partial to Hondas, and decided to not even look at the Camry, does that make the Accord a better car? Nope.

If I was in the market for a new family car, and decided to buy an Accord because I'm rather partial to Hondas, and decided to not even look at the Camry, does that make the Accord a better car? Nope.

#12

Knowing that a lot more Toyota truck owners traded in their old vehicles for a new Tundra than ever before is useless? Suit yourself. Like I said, it shows that the new Tundra is achieving a much higher loyalty rate, and the other bit of info shows that the new Tundra is achieving much higher conquest rates of domestic truck owners than the old model ever did. That's a very significant bit of information, as it shows the Tundra is slowly but surely winning over loyal domestic fans in a very tough market segment ... something which Toyota critics said couldn't be done.

Thread

Thread Starter

Forum

Replies

Last Post

LexFather

Car Chat

31

12-11-07 04:04 PM

Gojirra99

Car Chat

13

07-05-07 08:46 AM