Stopped by Mercedes, ADMs are GONE!

#47

These things don’t just happen out of the blue, there are precursors and causes. There is nothing in the economy that would cause an economic downturn like we saw in 2008. Bear in mind the economy is still growing and adding jobs despite the high inflation, and inflation is cooling not continuing to rise.

#48

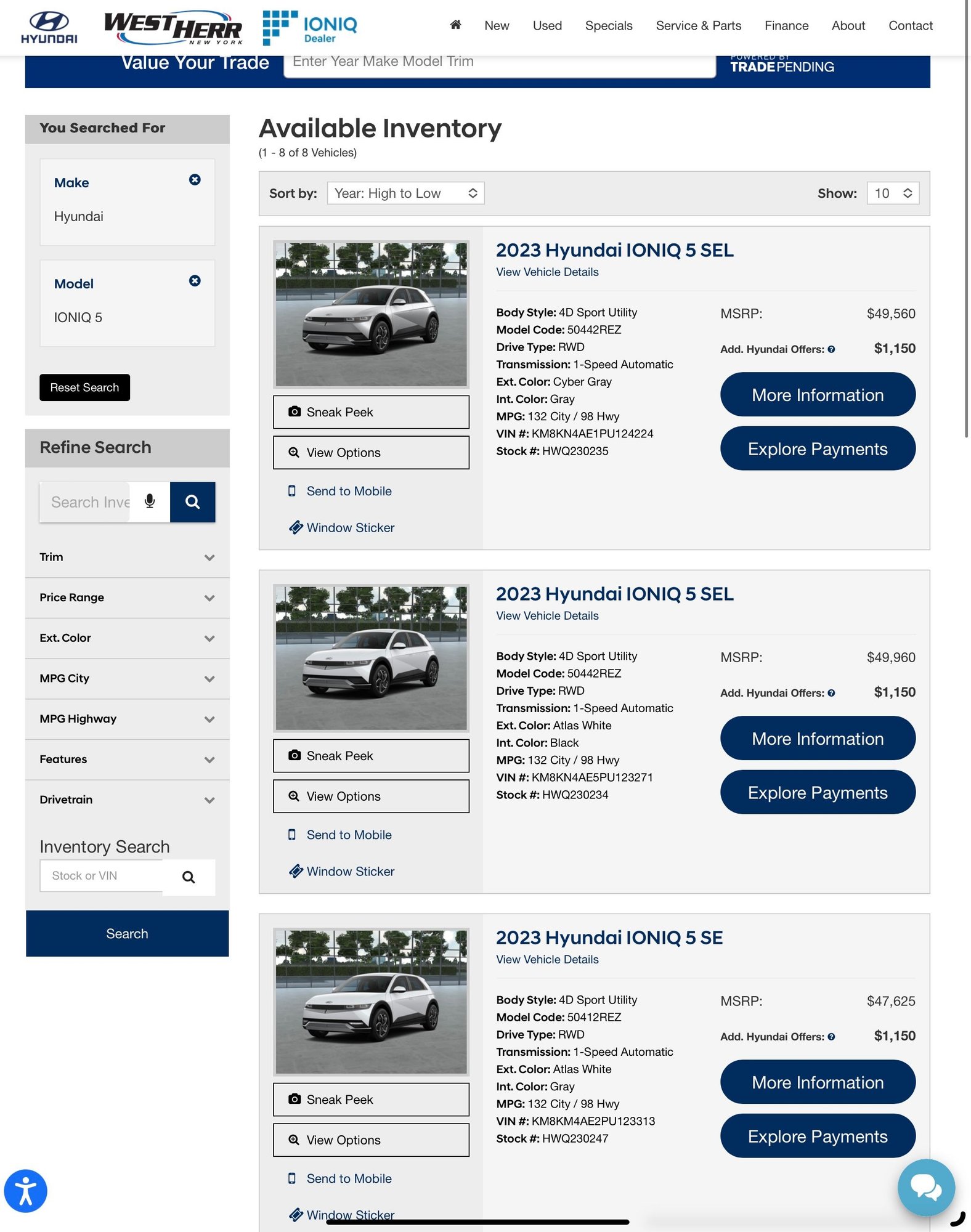

Plenty in stock. They are too expensive to continue selling long term. Hyundai really can’t command those type of prices in the long term. Especially went times start to get tough for people.

https://www.westherrhyundai.com/sear...odel=IONIQ%205

These things don’t just happen out of the blue, there are precursors and causes. There is nothing in the economy that would cause an economic downturn like we saw in 2008. Bear in mind the economy is still growing and adding jobs despite the high inflation, and inflation is cooling not continuing to rise.

Last edited by Toys4RJill; 12-18-22 at 10:25 AM.

#49

Plenty in stock. They are too expensive to continue selling long term. Hyundai really can’t command those type of prices in the long term. Especially went times start to get tough for people.

https://www.westherrhyundai.com/sear...odel=IONIQ%205

https://www.westherrhyundai.com/sear...odel=IONIQ%205

#50

These things don’t just happen out of the blue, there are precursors and causes. There is nothing in the economy that would cause an economic downturn like we saw in 2008. Bear in mind the economy is still growing and adding jobs despite the high inflation, and inflation is cooling not continuing to rise.

#52

#53

the vast majority of people have no idea what is coming if 10% rates happen. People who having being buying cars for more than MSRP have made a huge mistake. I do agree that there is a way to make money at these times.

#54

Originally Posted by LexsCTJill

What doesn’t happen out of the blue? Nobody really knows for sure how sour it will go. But if the war in Europe starts to get worse and the energy crisis gets worse…you’ll see economic disaster.

Inflation always exists, normal inflation is 3.5-4%. So, it always rises. Cooling increases in car and home prices will help the inflation figure tremendously.

#55

They all want to keep their jobs, that’s why they won’t say it as it goes against the mainstream narrative, people don’t want to hear hard talk…remember when we were promised that inflation was “transitory”. … Inflation would be over tomorrow if rates were raised to double digits today. The vast majority of people can’t absorb the current interest rate hikes. More interest rate hikes are already coming for 2023 and that has already been announced

Last edited by Toys4RJill; 12-18-22 at 12:36 PM.

#56

They all want to keep their jobs, that’s why they won’t say it as it goes against the mainstream narrative, people don’t want to hear hard talk…remember when we were promised that inflation was “transitory”. … Inflation would be over tomorrow if rates were raised to double digits today. The vast majority of people can’t absorb the current interest rate hikes. More interest rate hikes are already coming for 2023 and that has already been announced

It’s not as simple as just “crushing inflation” it’s delicate. You don’t want to curtail inflation and destroy the economy and harm people in the process, would we rather have 5% inflation and a still moving and prosperous economy? Yes.

That’s why they only raised the fed funds rate .5% this time vs .75%, because they see the end in sight and they will start easing off. Yes you will see more hikes but they will be smaller and smaller. And yes, people can absorb the higher rates. If they couldnt, then spending and hiring and growth would have collapsed and they haven’t.

#57

A lot of “if this happens” there. Well we could have another pandemic, we could get hit by a meteor, we could get nuked. With that thought process we are always on the brink of disaster.

Inflation always exists, normal inflation is 3.5-4%. So, it always rises. Cooling increases in car and home prices will help the inflation figure tremendously.

No legitimate economist I have ever seen predicts that.

Inflation always exists, normal inflation is 3.5-4%. So, it always rises. Cooling increases in car and home prices will help the inflation figure tremendously.

No legitimate economist I have ever seen predicts that.

#58

Sorry, but that’s not true. My company has private economists that we hire to give us predictions, they have no reason to lie, and none of those outlooks are what you say, they are largely the same as what you see in the mainstream.

It’s not as simple as just “crushing inflation” it’s delicate. You don’t want to curtail inflation and destroy the economy and harm people in the process, would we rather have 5% inflation and a still moving and prosperous economy? Yes.

That’s why they only raised the fed funds rate .5% this time vs .75%, because they see the end in sight and they will start easing off. Yes you will see more hikes but they will be smaller and smaller. And yes, people can absorb the higher rates. If they couldnt, then spending and hiring and growth would have collapsed and they haven’t.

It’s not as simple as just “crushing inflation” it’s delicate. You don’t want to curtail inflation and destroy the economy and harm people in the process, would we rather have 5% inflation and a still moving and prosperous economy? Yes.

That’s why they only raised the fed funds rate .5% this time vs .75%, because they see the end in sight and they will start easing off. Yes you will see more hikes but they will be smaller and smaller. And yes, people can absorb the higher rates. If they couldnt, then spending and hiring and growth would have collapsed and they haven’t.

Last edited by Toys4RJill; 12-18-22 at 01:00 PM.

#59

Sorry, but that’s not true. My company has private economists that we hire to give us predictions, they have no reason to lie, and none of those outlooks are what you say, they are largely the same as what you see in the mainstream.

It’s not as simple as just “crushing inflation” it’s delicate. You don’t want to curtail inflation and destroy the economy and harm people in the process, would we rather have 5% inflation and a still moving and prosperous economy? Yes.

That’s why they only raised the fed funds rate .5% this time vs .75%, because they see the end in sight and they will start easing off. Yes you will see more hikes but they will be smaller and smaller. And yes, people can absorb the higher rates. If they couldnt, then spending and hiring and growth would have collapsed and they haven’t.

It’s not as simple as just “crushing inflation” it’s delicate. You don’t want to curtail inflation and destroy the economy and harm people in the process, would we rather have 5% inflation and a still moving and prosperous economy? Yes.

That’s why they only raised the fed funds rate .5% this time vs .75%, because they see the end in sight and they will start easing off. Yes you will see more hikes but they will be smaller and smaller. And yes, people can absorb the higher rates. If they couldnt, then spending and hiring and growth would have collapsed and they haven’t.

..

..