Tesla business discussion

#31

Pole Position

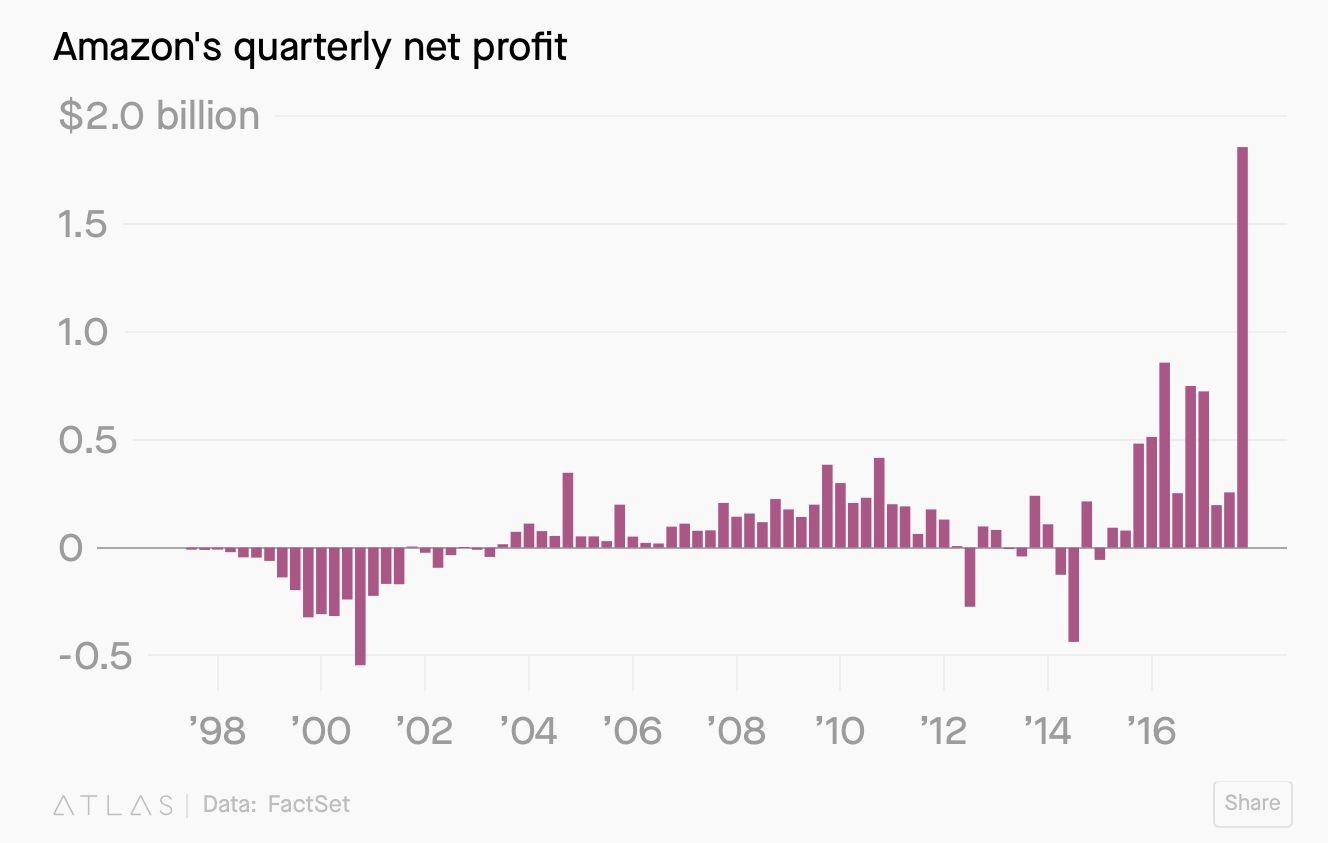

Amazon started in 1994 and turned public in 1997. It was profitable in 2001. Tesla started in 2003. Their worst year was 2017, their 14th year with a loss of 1.96 billion. Their next worst loss was their 15th year 2018 with a loss of 1.1 billion. So far this year they have lost 1.1 billion. They have never come close to making a profit in 16 years. Comparing Tesla with Amazon is truly the apples to oranges.

#32

Lexus Fanatic

Wrong. Apparently you don't follow my posts. I have posted, numerous times, on the sins and abuses of Ferdinand Piech at VW, Henry Ford II's fiefdom/dictatorship when he ran Ford, Lee Iacocca's double-talk when he ran Chrysler, Mercedes' Dieter Zetsche's abuse of the Daimler/Chrysler partnership, John DeLorean's cocaine-running to support his failing company (though he claimed to the day he died that it was a set-up), The inexcusable manner that GM and Ford are both being run today, and numerous other examples. I don't sugar-coat situations that don't deserve to be sugar-coated.

I'm not criticizing his past along those lines. At one time, he was a brilliant entrepreneur, and he indeed founded a company that produced some electric vehicles (and battery/power-systems) of remarkable range and capacity. But it was also founded on some very questionable principles of company-organization, and somewhere along the way (might have been his latest girl-friend....who knows?)....something came into his life that simply went to his head, and he has been on a downward spiral ever since.

Much of what Lutz predicted has already come to pass,

although it is true that Tesla is not bankrupt yet.

Their stock, though, is classically overpriced, and in a bubble. And, with all of the assembly-line defects in the Model 3 and Model X, they are going to lose a ton of money in warranty work.

#33

Lexus Test Driver

Originally Posted by LexsCTJill

What I am getting is that, I see many comments lamenting the dealer set up...or the service set up...(which is fine) ...then I hear that Tesla has this revolutionary way of selling direct...I just contrast that with the idea that they are not making profit...and I further read there are no discounts available...I truly do not see Tesla becoming successful with a dealer model...but that is just my opinion.

#34

Lexus Fanatic

I'll let the mods decide, but seems to me like we've gotten off-topic, from individual BEV owners' electric-recharging bills to Tesla's own financial state.

#35

Lexus Fanatic

I suggest changing the thread title to General Tesla Discussion or something along those lines.

#36

Pole Position

- The S&P is up +20.7% ytd and Tesla stock is down -31.48%. They have been in business 16 years and their three worst losses will be their last three. Their 14th year (2017) was the their worst loss of 1.96 billion with a B. Their 15th year (2018) they only lost 1.1 billion. Their 16th year 2019, the first quarter loss was 702 million followed by a 408 million loss for the second quarter. It gets worse. The tax credit goes from $1,875 to 0 on 1/1/2020. Musk proves that even with record sales they are still losing money. Audi and Mercedes will be coming out in a couple of months with full electric SUV that will be less expensive then the Model X, more dependable, better looking and a full $7,500 tax credit. Consumer Reports ranks Tesla 27th out of 29th in reliability. Two of their three models they do not recommend. They stated the top 10 dogs to avoid and the Model X was #1. The Model S has the highest insurance of any vehicle. Tesla sells 40% of their vehicles in California. The Model S sales have plummeted 54% in California from the first quarter of this year to the second. This week their chief of technology left. Analyst called him second in command. In January their CFO left. Their chief of engineering left in 2018. Musk has almost lost recently his executive team. Musk is the captain of the Titanic.

Last edited by Freds430; 07-27-19 at 02:39 PM.

#37

Lexus Test Driver

Originally Posted by Freds430

- The S&P is up +20.7% ytd and Tesla stock is down -31.48%. They have been in business 16 years and their three worst losses will be their last three. Their 14th year (2017) was the their worst loss of 1.96 billion with a B. Their 15th year (2018) they only lost 1.1 billion. Their 16th year 2019, the first quarter loss was 702 million followed by a 408 million loss for the second quarter. It gets worse. The tax credit goes from $1,875 to 0 on 1/1/2020. Musk proves that even with record sales they are still losing money. Audi and Mercedes will be coming out in a couple of months with full electric SUV that will be less expensive then the Model X, more dependable, better looking and a full $7,500 tax credit. Consumer Reports ranks Tesla 27th out of 29th in reliability. Two of their three models they do not recommend. They stated the top 10 dogs to avoid and the Model X was #1. The Model S has the highest insurance of any vehicle. This week their chief of technology left. Analyst called him second in command. In January their CFO left. Their chief of engineering left in 2018. Musk has almost lost recently his executive team. Musk is the captain of the Titanic.

#38

Lexus Fanatic

- The S&P is up +20.7% ytd and Tesla stock is down -31.48%. They have been in business 16 years and their three worst losses will be their last three. Their 14th year (2017) was the their worst loss of 1.96 billion with a B. Their 15th year (2018) they only lost 1.1 billion. Their 16th year 2019, the first quarter loss was 702 million followed by a 408 million loss for the second quarter. It gets worse. The tax credit goes from $1,875 to 0 on 1/1/2020. Musk proves that even with record sales they are still losing money. Audi and Mercedes will be coming out in a couple of months with full electric SUV that will be less expensive then the Model X, more dependable, better looking and a full $7,500 tax credit. Consumer Reports ranks Tesla 27th out of 29th in reliability. Two of their three models they do not recommend. They stated the top 10 dogs to avoid and the Model X was #1. The Model S has the highest insurance of any vehicle. This week their chief of technology left. Analyst called him second in command. In January their CFO left. Their chief of engineering left in 2018. Musk has almost lost recently his executive team. Musk is the captain of the Titanic.

#39

Lexus Fanatic

I'm convinced some people will never be happy until Tesla goes under the amount of FUD and general negativity tossed at the company is unprecedented. It even extends to the tech press and investors in general. What this tells me is Tesla is a massive threat to the established brands.

#40

Lexus Test Driver

Originally Posted by Lexus2000

I'm convinced some people will never be happy until Tesla goes under the amount of FUD and general negativity tossed at the company is unprecedented. It even extends to the tech press and investors in general. What this tells me is Tesla is a massive threat to the established brands.

People need to read articles around how the company is performing from a financial perspective.

https://www.forbes.com/sites/hershsh.../#25e1df056974

Tesla isn't going anywhere soon so if people like the car, they shouldn't be afraid to get it.

#41

Lexus Fanatic

iTrader: (20)

I am not a fan of dealers, I would rather by via no-haggle. But for the masses, third party dealers bring down prices for the consumers.

Electric cars ruin the model... there’s little to no service revenue, dealers can and do make money on new (non-tesla) electric vehicles with the usual shell game or mark it up only to mark it down... bottom line, there’s no chance cars would be cheaper through third party dealers especially since there’s no service revenue.

#42

Lexus Fanatic

iTrader: (20)

Tesla started in 2003. Their worst year was 2017, their 14th year with a loss of 1.96 billion. Their next worst loss was their 15th year 2018 with a loss of 1.1 billion. So far this year they have lost 1.1 billion. They have never come close to making a profit in 16 years. Comparing Tesla with Amazon is truly the apples to oranges.

#43

Lexus Fanatic

iTrader: (20)

People need to read articles around how the company is performing from a financial perspective.

https://www.forbes.com/sites/hershsh.../#25e1df056974

Tesla isn't going anywhere soon so if people like the car, they shouldn't be afraid to get it.

https://www.forbes.com/sites/hershsh.../#25e1df056974

Tesla isn't going anywhere soon so if people like the car, they shouldn't be afraid to get it.

). Thanks.

). Thanks.this part is worth noting:

The reason why Tesla’s sales disappointed analysts despite its record volume is that Telsa decreased the price of its Model 3 in response to competition. Competition is an important factor which generally prevents firms from earning more than their cost of capital in the long run. As it happens, the analysts who based their target prices assuming that Tesla would be priced at intrinsic value a year hence have uniformly assumed that Tesla will earn more than its cost of capital in the long run. This suggests that Tesla’s stock is even more overvalued than these analysts estimated.

Some investors buy and hold Tesla’s stock because they believe that Tesla is a good company. These investors would do well to understand that stocks of good companies are not often good stocks.

Some investors buy and hold Tesla’s stock because they value Tesla’s mission to produce electric cars in order to combat climate change. Doing so is a noble motive, but should be done with eyes wide open about the risk of holding a stock that is overvalued on fundamental grounds.

All in all, Tesla’s shareholders would do well to pay attention to what Elon Musk has announced about Tesla’s free cash flow stream.

Some investors buy and hold Tesla’s stock because they believe that Tesla is a good company. These investors would do well to understand that stocks of good companies are not often good stocks.

Some investors buy and hold Tesla’s stock because they value Tesla’s mission to produce electric cars in order to combat climate change. Doing so is a noble motive, but should be done with eyes wide open about the risk of holding a stock that is overvalued on fundamental grounds.

All in all, Tesla’s shareholders would do well to pay attention to what Elon Musk has announced about Tesla’s free cash flow stream.

#44

Lexus Test Driver

Originally Posted by bitkahuna

That was actually a good article (rare for forbes  ). Thanks.

). Thanks.

this part is worth noting:

). Thanks.

). Thanks.this part is worth noting:

#45

Lexus Fanatic

It's the uninformed that are susceptible to the FUD. The vast majority of the public doesn't understand stock valuation and company financials.

People need to read articles around how the company is performing from a financial perspective.

https://www.forbes.com/sites/hershsh.../#25e1df056974

Tesla isn't going anywhere soon so if people like the car, they shouldn't be afraid to get it.

People need to read articles around how the company is performing from a financial perspective.

https://www.forbes.com/sites/hershsh.../#25e1df056974

Tesla isn't going anywhere soon so if people like the car, they shouldn't be afraid to get it.

As for lack of service, a Tesla still needs service. Coolant, brakes, cabin filters, tires, brake fluid, high efficiency HEPA filter, air conditioning service and a strange winter calliper lub service. https://www.tesla.com/en_CA/support/car-maintenance