First damage - tree branch fell on the quarter panel

#46

#48

I'll be sure to hold them to a high standard when I go pick up the car. If the paint doesn't look right, I will ask them to re-do it.

#49

So, I just wanted to share something that's been going on. It is nothing specific to the IS 500.

Geico and my body shop do not seem to agree on labor and paint rates for the car. Geico only wants to cover $50/hr, and the shop wants to charge $55/hr for labor, for example. Paint is in a similar boat: $34/hr from Geico, but $43/hr from the shop.

I did a little Google research (lol), and it seems a few other shops in the area charge similar amounts for body work and paint work. So, I fear Geico is simply low-balling the shop here, and they are leaving me to cover the remaining amount.

However, what I would have liked to do here is simply find a different shop. Geico claims that they rarely have these occurrences in this area - it's only this shop, supposedly. However, the shop also says they always have issues with Geico, not so much other insurance companies. They went as far as to say "Geico is just so behind the times. You can't go to the paint store and buy house paint for $34. My point being, automotive paint is more sophisticated and refined even than house paint..." You get the idea. Having said all that, what it means for me is that Geico's covered amount is going to come up nearly $300 short.

This is after I paid a deductible, mind, and have been paying monthly to Geico for quite some time.

I feel dissatisfied with both parties. One, the body shop. They gave me an ETA of "a week, maybe a few days more", and it's been over two weeks now, with some supposed pending work to do. Also, if this has been a repeated issue with Geico, why not surface that to me, the customer, before you take my car hostage and THEN tell me there's going to be a difference? Oh, because you'd rather have me sign a sneakily-worded piece of paper saying you'll get the money either way. OK then. Two, Geico. If your reimbursed rates don't align with the market, it sounds like your product is simply not great. Sure, you have given me by far the lowest rates I could have gotten, as far as I can tell. However, I'd rather pay a little more for the piece of mind that you would actually cover the costs of repairs after my deductible, especially when said costs follow market averages.

So, I still don't have my car and am being asked to pay for uncovered costs. All on a car that got damaged when I did nothing wrong.

Geico and my body shop do not seem to agree on labor and paint rates for the car. Geico only wants to cover $50/hr, and the shop wants to charge $55/hr for labor, for example. Paint is in a similar boat: $34/hr from Geico, but $43/hr from the shop.

I did a little Google research (lol), and it seems a few other shops in the area charge similar amounts for body work and paint work. So, I fear Geico is simply low-balling the shop here, and they are leaving me to cover the remaining amount.

However, what I would have liked to do here is simply find a different shop. Geico claims that they rarely have these occurrences in this area - it's only this shop, supposedly. However, the shop also says they always have issues with Geico, not so much other insurance companies. They went as far as to say "Geico is just so behind the times. You can't go to the paint store and buy house paint for $34. My point being, automotive paint is more sophisticated and refined even than house paint..." You get the idea. Having said all that, what it means for me is that Geico's covered amount is going to come up nearly $300 short.

This is after I paid a deductible, mind, and have been paying monthly to Geico for quite some time.

I feel dissatisfied with both parties. One, the body shop. They gave me an ETA of "a week, maybe a few days more", and it's been over two weeks now, with some supposed pending work to do. Also, if this has been a repeated issue with Geico, why not surface that to me, the customer, before you take my car hostage and THEN tell me there's going to be a difference? Oh, because you'd rather have me sign a sneakily-worded piece of paper saying you'll get the money either way. OK then. Two, Geico. If your reimbursed rates don't align with the market, it sounds like your product is simply not great. Sure, you have given me by far the lowest rates I could have gotten, as far as I can tell. However, I'd rather pay a little more for the piece of mind that you would actually cover the costs of repairs after my deductible, especially when said costs follow market averages.

So, I still don't have my car and am being asked to pay for uncovered costs. All on a car that got damaged when I did nothing wrong.

#50

So, I just wanted to share something that's been going on. It is nothing specific to the IS 500.

Geico and my body shop do not seem to agree on labor and paint rates for the car. Geico only wants to cover $50/hr, and the shop wants to charge $55/hr for labor, for example. Paint is in a similar boat: $34/hr from Geico, but $43/hr from the shop.

I did a little Google research (lol), and it seems a few other shops in the area charge similar amounts for body work and paint work. So, I fear Geico is simply low-balling the shop here, and they are leaving me to cover the remaining amount.

However, what I would have liked to do here is simply find a different shop. Geico claims that they rarely have these occurrences in this area - it's only this shop, supposedly. However, the shop also says they always have issues with Geico, not so much other insurance companies. They went as far as to say "Geico is just so behind the times. You can't go to the paint store and buy house paint for $34. My point being, automotive paint is more sophisticated and refined even than house paint..." You get the idea. Having said all that, what it means for me is that Geico's covered amount is going to come up nearly $300 short.

This is after I paid a deductible, mind, and have been paying monthly to Geico for quite some time.

I feel dissatisfied with both parties. One, the body shop. They gave me an ETA of "a week, maybe a few days more", and it's been over two weeks now, with some supposed pending work to do. Also, if this has been a repeated issue with Geico, why not surface that to me, the customer, before you take my car hostage and THEN tell me there's going to be a difference? Oh, because you'd rather have me sign a sneakily-worded piece of paper saying you'll get the money either way. OK then. Two, Geico. If your reimbursed rates don't align with the market, it sounds like your product is simply not great. Sure, you have given me by far the lowest rates I could have gotten, as far as I can tell. However, I'd rather pay a little more for the piece of mind that you would actually cover the costs of repairs after my deductible, especially when said costs follow market averages.

So, I still don't have my car and am being asked to pay for uncovered costs. All on a car that got damaged when I did nothing wrong.

Geico and my body shop do not seem to agree on labor and paint rates for the car. Geico only wants to cover $50/hr, and the shop wants to charge $55/hr for labor, for example. Paint is in a similar boat: $34/hr from Geico, but $43/hr from the shop.

I did a little Google research (lol), and it seems a few other shops in the area charge similar amounts for body work and paint work. So, I fear Geico is simply low-balling the shop here, and they are leaving me to cover the remaining amount.

However, what I would have liked to do here is simply find a different shop. Geico claims that they rarely have these occurrences in this area - it's only this shop, supposedly. However, the shop also says they always have issues with Geico, not so much other insurance companies. They went as far as to say "Geico is just so behind the times. You can't go to the paint store and buy house paint for $34. My point being, automotive paint is more sophisticated and refined even than house paint..." You get the idea. Having said all that, what it means for me is that Geico's covered amount is going to come up nearly $300 short.

This is after I paid a deductible, mind, and have been paying monthly to Geico for quite some time.

I feel dissatisfied with both parties. One, the body shop. They gave me an ETA of "a week, maybe a few days more", and it's been over two weeks now, with some supposed pending work to do. Also, if this has been a repeated issue with Geico, why not surface that to me, the customer, before you take my car hostage and THEN tell me there's going to be a difference? Oh, because you'd rather have me sign a sneakily-worded piece of paper saying you'll get the money either way. OK then. Two, Geico. If your reimbursed rates don't align with the market, it sounds like your product is simply not great. Sure, you have given me by far the lowest rates I could have gotten, as far as I can tell. However, I'd rather pay a little more for the piece of mind that you would actually cover the costs of repairs after my deductible, especially when said costs follow market averages.

So, I still don't have my car and am being asked to pay for uncovered costs. All on a car that got damaged when I did nothing wrong.

The following users liked this post:

wthrman2 (05-04-23)

#51

#52

#53

... receipt of which is

hereby acknowledged, does hereby release, acquit and forever discharge Chateau Elan, Endurance

Assurance Corporation, Sompo International Insurance and Gallagher Bassett TPA, its officers, directors,

agents, attorneys, employees, associated companies, affiliates, and subsidiary companies, of and from and all

claims, causes of action costs and demands of whatever name or nature and any matter arising or growing

out of or on account of a loss which occurred as a result of an incident on or about April 01, 2023 at 100 Rue

Charlemagne, Braselton, GA 30517.

hereby acknowledged, does hereby release, acquit and forever discharge Chateau Elan, Endurance

Assurance Corporation, Sompo International Insurance and Gallagher Bassett TPA, its officers, directors,

agents, attorneys, employees, associated companies, affiliates, and subsidiary companies, of and from and all

claims, causes of action costs and demands of whatever name or nature and any matter arising or growing

out of or on account of a loss which occurred as a result of an incident on or about April 01, 2023 at 100 Rue

Charlemagne, Braselton, GA 30517.

#54

Ah snap. You signed a release. Sorry to hear all this. I personally wouldíve asked for them to pay for the repair without involving your insurance at all. Thatís why THEY carry insurance

The following users liked this post:

llO0DQLE (10-01-23)

#55

Still, I am paying Geico for a service which seems like it is not up to date with the market, which is sad.

#56

So, I just wanted to share something that's been going on. It is nothing specific to the IS 500.

Geico and my body shop do not seem to agree on labor and paint rates for the car. Geico only wants to cover $50/hr, and the shop wants to charge $55/hr for labor, for example. Paint is in a similar boat: $34/hr from Geico, but $43/hr from the shop.

I did a little Google research (lol), and it seems a few other shops in the area charge similar amounts for body work and paint work. So, I fear Geico is simply low-balling the shop here, and they are leaving me to cover the remaining amount.

Geico and my body shop do not seem to agree on labor and paint rates for the car. Geico only wants to cover $50/hr, and the shop wants to charge $55/hr for labor, for example. Paint is in a similar boat: $34/hr from Geico, but $43/hr from the shop.

I did a little Google research (lol), and it seems a few other shops in the area charge similar amounts for body work and paint work. So, I fear Geico is simply low-balling the shop here, and they are leaving me to cover the remaining amount.

I am sorry to hear you still do not have your car back

I really hope this all gets resolved soon and up to your expectations!

I really hope this all gets resolved soon and up to your expectations!

The following users liked this post:

arentz07 (05-04-23)

#58

Geico is on my naughty list for insurance companies and I know of shops here that just don't want to deal with cars under that insurance. They are notorious for doing this... so while they advertise lower rates, you pay out the a** later to get things fixed at a non-DRP (direct repair partner) shop. Your body shop should have also been more forthcoming on this as it should not be new to them about the rate differences. The estimator should know what rates the most common insurance companies will cover; Geico does fall under the "common" category.

I am sorry to hear you still do not have your car back I really hope this all gets resolved soon and up to your expectations!

I really hope this all gets resolved soon and up to your expectations!

I am sorry to hear you still do not have your car back

I really hope this all gets resolved soon and up to your expectations!

I really hope this all gets resolved soon and up to your expectations!So how much total out of pocket is this costing you @arentz07 ? I thought the deductible would be the only cost.

The following users liked this post:

macmaster (05-04-23)

#59

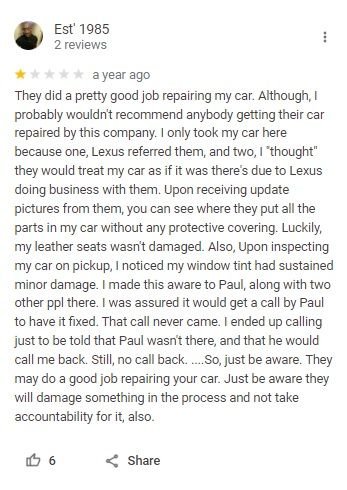

Yeah it just feels like I am in a situation where both of the other parties are pointing the finger at one another and refusing to work something out. The customer service at the shop has been so-so as well. Literally every time I've called, the advisor I've been working with was "away from his desk". And he never called back whenever I left a message.

Hence, my frustration. The deductible is supposed to be the only cost. I had a $1k deductible and am being asked to pay at least $259 (don't know the exact number because of a recent supplement).

Hence, my frustration. The deductible is supposed to be the only cost. I had a $1k deductible and am being asked to pay at least $259 (don't know the exact number because of a recent supplement).

#60

I have heard good things about the quality of the work. But of course, I plan to get it out in the sunlight and do a careful walk-around and make sure everything looks good. At the end of the day, I want the car back more than anything. I just don't want anyone - Geico nor the body shop - to use that to take advantage of me.

Glad they are doing it right....

Glad they are doing it right....